Has the long-anticipated boom in multifamily housing construction finally ignited a capacity glut that will lower rents and reduce pressure on renters to buy?

Rental growth has fallen to the lowest level in six years and rents in top luxury markets have declined over the past four months in the wake of rising capacity. New apartment inventory levels grow by 50 percent in 2016 compared to 2015 (320,000 vs. 200,000 new units), according to rental listing service RENTCafé.

Construction peaked in 2015

Multifamily construction appears to have peaked in 2015, according to Dodge Data & Analytics. Rising capacity now is dampening apartment construction; in 2017, Dodge forecasts that construction housing will be flat in dollars and down 2 percent in units to 435,000. Continued growth for multifamily housing in many metropolitan areas, along with still generally healthy market fundamentals, will enable the retreat at the national level to stay gradual.

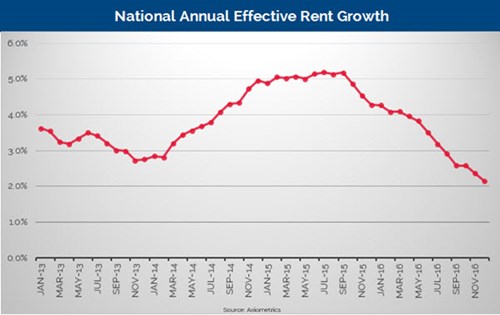

But the damage has been done to rental rates. Rising rents that outpaced home prices have been a significant factor motivating first-time buyers, but now over capacity is reversing the equation. In December, the long-term average national rental growth rate fell below 2.2 percent for the first time, reaching the lowest level since July 2010, according to Axiometrics.

The 94.5 percent occupancy rate in December was the lowest since the 94.3 percent of February 2014. December’s rate represented a 14-bps decrease from November’s 94.7 percent and a 27-bps drop from the 94.8 percent of December 2015. But occupancy is still well above the post-recession long-term average of 94.1 percent, underperforming the 2915 occupancy rate benchmark every month since last May.

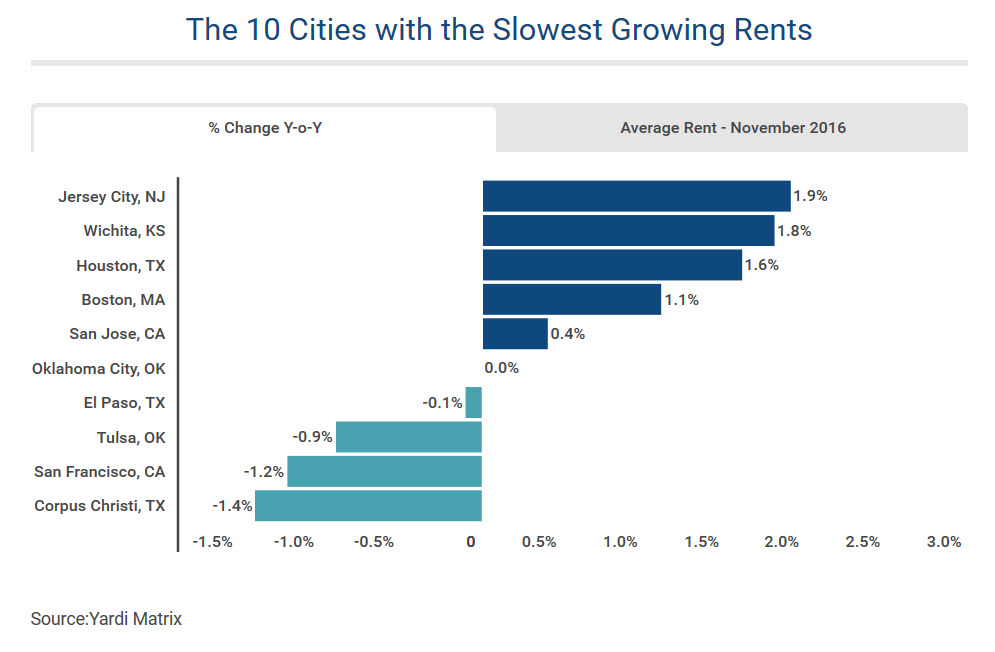

The decline has been affecting metro markets across the board. Only 13 metros among the Axiometrics top 50 – based on number of units – recorded higher rent growth in December than they did in November. Just nine metros saw increases from their December 2015 rates. The seven metros recording negative rent growth in December included Houston, San Francisco, San Jose, Oakland and New York, all of which are among the largest apartment markets in the nation and, thus, have a large impact on the national rate. Birmingham and Oklahoma City were the other two markets with rent growth in the red.

Luxury markets hit hard

RENTCafé reported similar rental declines in November, the third month for consecutive rent decreases for high-end apartments, the national average dropped to $1,401, down 0.5 percent from October and 1.2 percent from the $1,418 all-time high recorded in August. The average rent for luxury apartments has been on a very gradual downward slope for the last 4 months, reaching $1,397 in December.

Cities where supply is finally catching up with demand have started seeing rent moderation; with a staggering 126 percent increase in new unit deliveries in 2016,. San Francisco rents fell 1.6 percent from October and 1.2 percent from the same time last year. In November 2016, San Francisco was the second fastest growing rental market in the U.S. with rent growth topping 11 percent.

The flood of new supply also hit Boston and Houston, which rank 7th and 8th on RENTCafe’s list of cities with the slowest growing rents Y-O-Y. With approximately 7,600 new units to be delivered by the end of 2016, Boston rents fell 0.5 percent from October and only increased 1.1 percent from the same time last year.

Looking to the start of 2017, Axiometrics suggests that the trend of strong starts to the year that took hold the past few years could change. An underperforming early 2017 might very well lead to annual rent-growth rates below 2.0 percent for a few months.