Rising mortgage interest rates and their impact on mortgage affordability beat out inventory shorttagers as the most significant force driving the 2017 housing market, according to the latest Zillow Home Price Expectations Survey.

On average, experts said rates on a 30-year, fixed mortgage will need to reach 5.65 percent before significantly impacting home value growth, though a sizable share said rates of 5 percent or lower will have an impact.

Tne 100-plus experts expect U.S. median home values to grow 4.4 percent year-over-year in 2017, on average, and to exceed pre-recession peak values by April of this year.

For years, falling interest rates have been a boon to the U.S. housing market, keeping monthly mortgage payments low for first-time buyers and move-up buyers alike, even as home values rose. But in 2017, rising mortgage interest rates will have the opposite effect and are set to have a larger impact than any other housing trend this year, according to the Q1 2017 Zillow Home Price Expectations survey (ZHPE).

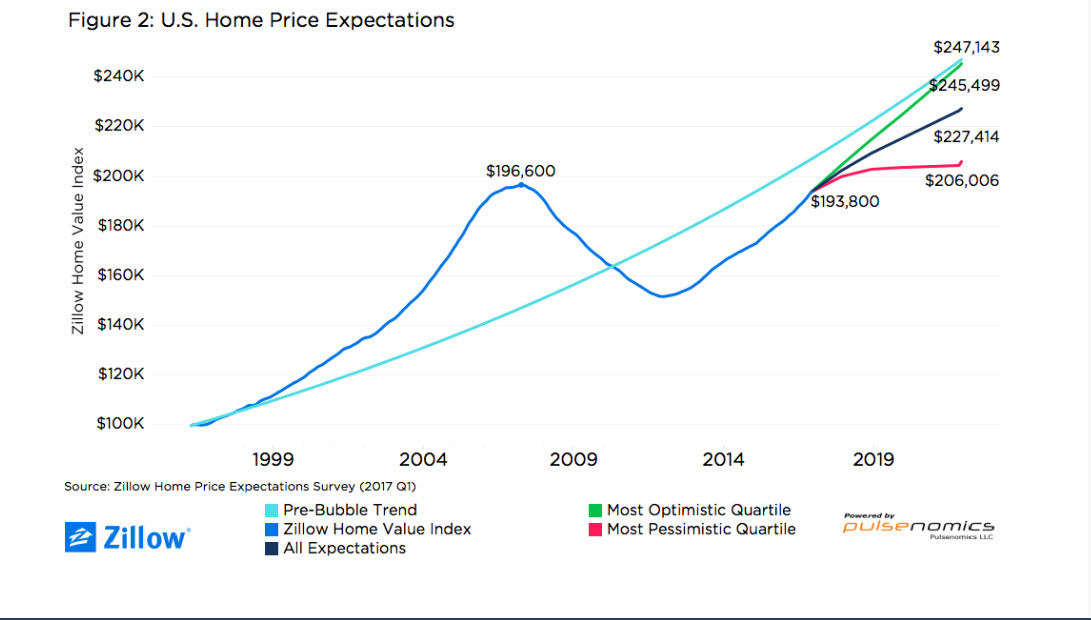

The potential impact of rising mortgage interest rates this year will be doubly important in the face of continuing – and accelerating – home value appreciation nationwide. Panelists were also asked to predict the path of home value growth through 2021. Experts said they expected U.S. home values to grow 4.4 percent in 2017, up from expectations of 3.6 percent the last time this survey was conducted.

The potential impact of rising mortgage interest rates this year will be doubly important in the face of continuing – and accelerating – home value appreciation nationwide. Panelists were also asked to predict the path of home value growth through 2021. Experts said they expected U.S. home values to grow 4.4 percent in 2017, up from expectations of 3.6 percent the last time this survey was conducted.

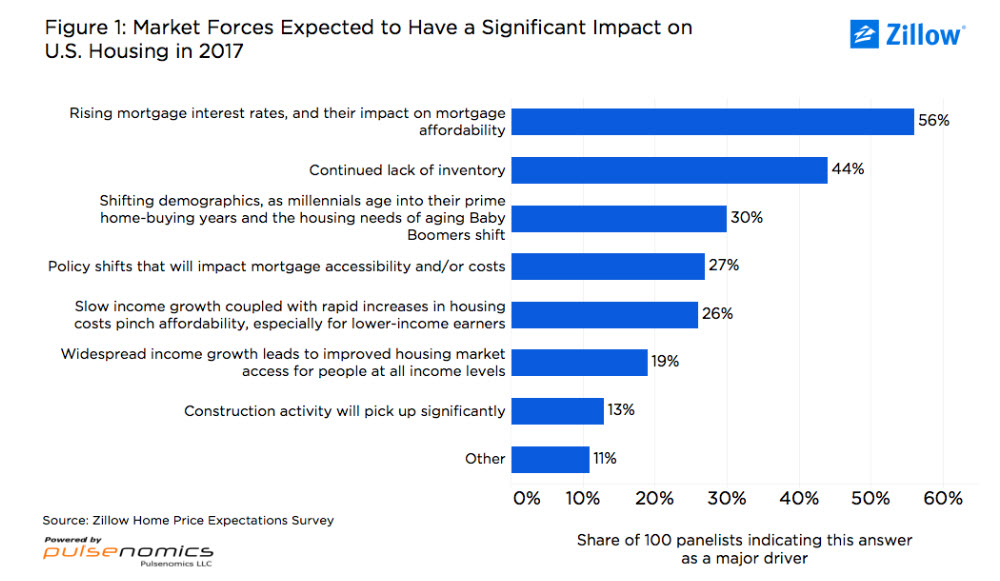

In the survey, panelists were asked to name up to three market forces they think will have the most significant impact on U.S. housing in 2017. Among the responses, “rising mortgage interest rates, and their impact on mortgage affordability” was named by 56 percent of panelists answering the question, the largest single response rate for any individual response option,

Mortgage interest rates play a key role in determining the affordability of a given home. When rates are low, the monthly payment on a home will be lower than the payment on the exact same home purchased with a loan featuring a higher interest rate. As of Q3 216, an American household earning the national median household income and seeking to buy the median-priced home could expect to pay about 14 percent of their income on a monthly mortgage payment – well below the historical average of 21 percent. The reason the share is far lower today than historically largely boils down to low mortgage rates.

Rising Rates, Declining Affordability

In the decades between the 1980s and 2000, mortgage rates on a 30-year, fixed-rate mortgage – the type of mortgage used by a majority of home buyers nationwide – averaged around 8 percent. But in the years immediately preceding the housing bubble and throughout the housing boom, bust and recovery, mortgage interest rates fell consistently, falling into the 3 percent range and staying there for several years. This helped keep monthly mortgage payments incredibly low and boost home affordability, even as U.S. home values themselves rose – often rapidly – and are now approaching all-time highs.

Lately, rates have begun rising again, largely in response to the Federal Reserve’s decision to raise the federal funds rate – which influences the mortgage rates offered by home lenders – for just the second time in a decade, with promises of similar hikes to come throughout 2017. Between November and early February, average rates on a 30-year, fixed-rate mortgage rose by about 50 basis points, or half of one percentage point, from about 3.75 percent to roughly 4.25 percent. While still low by historical standards, as rates rise, monthly payments for same-priced homes will increase, and buyers’ budgets will be more strained. Since 77 percent of buyers use a mortgage to finance their purchase, the market will likely not be able to sustain rapid home value appreciation.

When asked what level the 30-year, fixed mortgage rate will need to hit before it begins to significantly slow home value growth, panelists on average said 5.65 percent. It’s currently unlikely that rates will get that high by the end of 2017. The Fed’s own projections suggest about a 100 basis point increase in the Federal Funds Rate over the next year, putting conventional, 30-year, fixed mortgage rates in the 4.75 – 5 percent range by the end of 2017. But despite this seeming headroom for rates to grow, it’s important to note that a significant share of panelists with an opinion (22 percent) said mortgage interest rates of 5 percent or lower may begin impacting home value growth.

As rates rise, not only will home value growth and affordability be impacted, but the ability and/or desire of current homeowners to sell and move to another home will be, too. Rather than moving up, in a higher interest rate environment, many buyers may find that a home similar to the one they’re already living in – let alone larger or more expensive – would actually be less affordable than the one they currently own. As a result, they may choose to stay put and take advantage of the already low payment they’ve locked in. This could potentially exacerbate existing inventory shortages, and/or lead to reduced demand from home buyers. A majority of panelists with an opinion (56 percent) said this phenomenon of “mortgage rate lock-in” is already or will soon begin meaningfully impacting the housing market as rates rise.

Home Price Expectations: New Peak by Early Spring?

On average, panelists said they expected home values to end 2017 up 4.4 percent year-over-year. Looking farther ahead, panelists on average said they expected the annual pace of home value appreciation to slow to 3.4 percent in 2018, and 2.7 percent in 2019 and 2020, before re-accelerating somewhat to 2.8 percent in 2021. Cumulatively, experts said they expected home values to grow a total of 17.3 percent, on average, through 2021.

Panelists’ views were divided when separated into more optimistic and more pessimistic camps, especially when looking over the longer term. The most optimistic quartile of panelists said they expected U.S. home values to rise 5.6 percent through the end of this year. The most pessimistic 25 percent of panelists said they expected home values to rise 3.2 percent year-over-year through 2017. Looking farther out, the most optimistic panelists said they expected home values to grow by a total of 26.7 percent from now through the end of 2021. Pessimists predicted total, cumulative home value growth of just 6.3 percent over the same time (figure 2).

Median U.S. home values peaked at $196,600 in April 2007. On average, panelists said they expected the median U.S. home value to surpass this peak in April of this year – exactly a decade after home values peaked just before the Great Recession fully took hold.