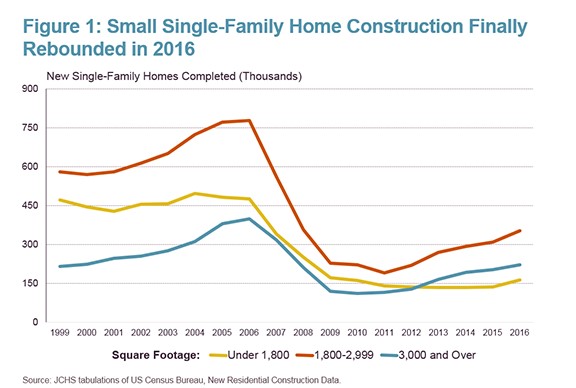

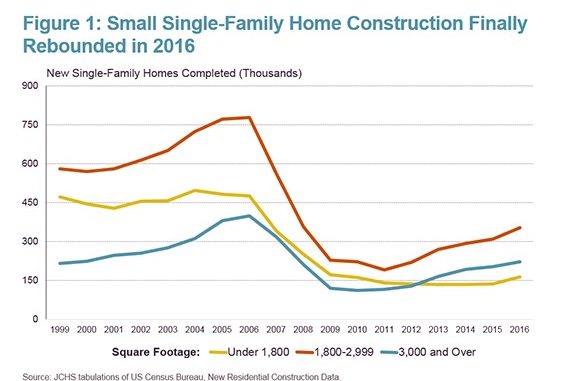

For the first time since 2004, construction of the smaller, entry-level homes in demand by young, first-timer buyers increased last year.

Census data released last month show that after years of stagnation, construction of smaller homes grew appreciably in 2016. New completions for homes under 1,800 square feet increased nearly 20 percent in 2016 to 163,000 units, the first significant growth since 2004 and the largest rise since the data series began in 1999, according to post in the Joint Center for Housing Studies’ blog by JCHS Research Assistant Alexander Hermann.

The growth in small home production is significant because many first-time and lower-income homebuyers hope to purchase smaller homes, which are less expensive than larger ones. A dearth of more affordable starter homes has kept thousands of first-time buyers in rentals, slowing overall sales and creating an affordability crisis in hotter markets, according to an analysis by Trulia’s Ralph McLaughlin. The median buyer needs to dedicate 39.1 percent of their monthly income to buy a starter home – a 3.1 percentage-point increase from last year and up from 31.7 percent in Q2 2012. Though trade-up and premium homes are still relatively affordable, the share of income these buyers would have to spend on such homes also reached post-recession highs. For example, trade-up and premium home buyers would need to spend 26 percent and 14.3 percent of their income to buy a home, respectively, but both are up from 21.5 percent and 11.7 percent just five years ago.

Even with the uptick in 2016, though, small-home construction remains 65 percent below the 464,000 units completed annually between 1999 and 2006 and comprises a much smaller share of newly-built housing than in the past. In 2016, small homes were 22 percent of single-family completions, well below their 37 percent market-share in 1999. In contrast, the share of large homes built grew from 17 percent in 1999 to 30 percent in 2016, while moderately-sized homes, which have consistently been the largest share of the market, have annually been 43-to-48 percent of all new single-family homes, Herman wrote.

Construction of condos and townhouses, possible alternatives to smaller single-family housing, also remains low. Builders of multifamily properties continue to focus on the rental market where demand remains strong. Consequently, only 28,000 condos were started in 2016, a modest increase from the 26,000 starts in 2015 but much lower than the 53,000 starts averaged annually in the 1990s. Similarly, townhouse starts grew from 86,000 units in 2015 to 98,000 units in 2016. While this is more than double the number of starts from 2009 and comparable to the 95,000 units started annually in the 1990s, it is less than half the number started in 2005.