The average Californian’s credit score may be middle-of-the-pack nationally, but only one state had a bigger improvement as the economy rebounded during the last seven years.

Credit watcher Experian’s annual report on national trends in “FICO” credit scores showed that last year’s California average of 708 was up two points in a year. That ranked 27th among the states. Credit scores reflect bill-paying abilities and are an important factor in how consumers obtain loans and what interest rates are charged.

The national average FICO score rose as well to a record high of 703 in 2019. That’s up from 701 in 2018. A 700 score is a critical credit quality yardstick for lenders and 59% of Americans hit or exceeded this lofty level of creditworthiness last year — a record high share.

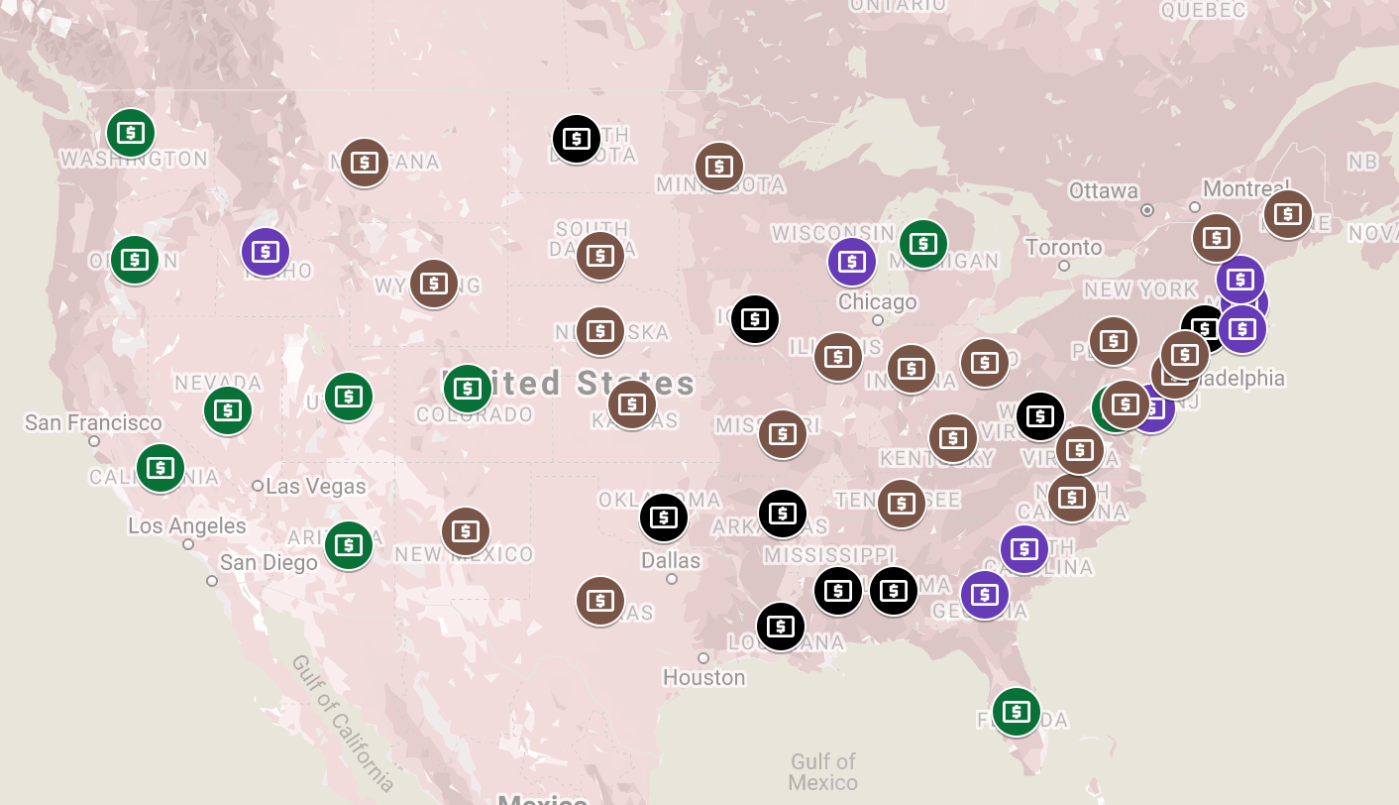

At the state level, 2019’s highest scores were found in Minnesota at 733, its eighth-consecutive year leading the nation. Next best was North Dakota and South Dakota at 727. Worst? Mississippi and Louisiana at 677 then Texas and Alabama at 680.

Things have certainly changed for the better for personal finances since 2012, as the economic recovery from the Great Recession was taking shape. The average Californian credit score in 2012 was 693, No. 31 among the states. National bests that year were Minnesota at 724, then North Dakota at 722 and South Dakota at 719. Worst? Mississippi at 663 then Nevada at 668 and South Carolina and Georgia at 671.

These results mirrors other data that shows California’s economic recovery from the Great Recession has helped the finances of many, but not all, residents. For example, unemployment statewide averaged 10.2% in 2012 and fell to a record-low 3.9% in November.

Look at credit scores in the 2012-19 period: The average Californian improved their credit score by 15 points, tying Michigan, Utah, and Washington for the second-biggest improvement. Tops was Nevada with an 18-point jump. All the states had improved scores in the seven years with the median FICO score gain being eight points. Alabama had the smallest increase, up just 3 points.

Note that credit scores are not just about who’s got the biggest paychecks.

When Creditcard.com compared 2018 FICO scores (California was No. 27 by their math) with household income (with California at No. 7) these analysts ranked Californians fourth-worst for “money management” skills just behind Alaska and just ahead of Texas, Maryland and Washington, D.C.

The report also noted that these bottom five states were among the nation’s youngest and length of credit history is a key factor in FICO calculations. That could have pulled these states’ average scores down. Also, these states have large foreign-born populations, another group with limited credit histories.

And credit scores add up to real money for borrowers as lenders set loan availability and the interest rates charged based on several criteria including credit scores.

Look at a study by LendingTree looking at the amount of interest paid over the life of five typical loans — mortgage, auto, education, credit card and personal. Borrowers with “very good” credit scores (740-799) would theoretically spend 20% less on interest charges than those with “fair” (580-669) scores.